Our Reinsurance Partners

Working with global leaders to enhance our risk management capabilities

Our Global Reinsurance Partners

We collaborate with top-rated reinsurers from around the world

SCOR

A top global reinsurer based in France, offering life and P&C reinsurance worldwide

SCR

Saudi Arabia’s national reinsurer, providing sharia-compliant and conventional reinsurance.

MENA Re

A pan-African reinsurer supporting insurance growth across the African continent.

Arab Re

Beirut-based reinsurer serving Arab and regional insurance markets.

kuwait Re

Reinsurer based in Kuwait, offering P&C solutions across the Middle East, Asia, and Africa.

Iraq Re

Iraq’s state-owned reinsurer, supporting local and regional insurance companies.

ADNIC

A leading UAE insurer offering health, motor, and property coverage.

TUNIS Re

Tunisia’s top reinsurer serving local and global markets.

All our reinsurance partners are carefully selected based on their financial strength, industry reputation, and track record of claims payment.

The Power of Reinsurance

How reinsurance strengthens our ability to protect our clients

Reinsurance is a vital component of our risk management strategy, enabling us to offer broader coverage and greater financial security to our clients.

By partnering with world-class reinsurers, we distribute risk globally, enhance our underwriting capacity, and maintain the financial strength to handle major claims events.

Our reinsurance program is carefully structured to provide optimal protection across our diverse portfolio of insurance products and services.

Benefits of Our Reinsurance Program

How our reinsurance partnerships create value for our clients and stakeholders

Enhanced Capital Strength

Our reinsurance partnerships strengthen our financial position, allowing us to handle larger risks with confidence.

Financial Stability

Reinsurance provides protection against catastrophic events, ensuring our long-term financial stability.

Increased Capacity

We can underwrite larger and more complex risks thanks to our robust reinsurance arrangements.

Technical Expertise

We gain access to specialized knowledge and global best practices through our reinsurance partners.

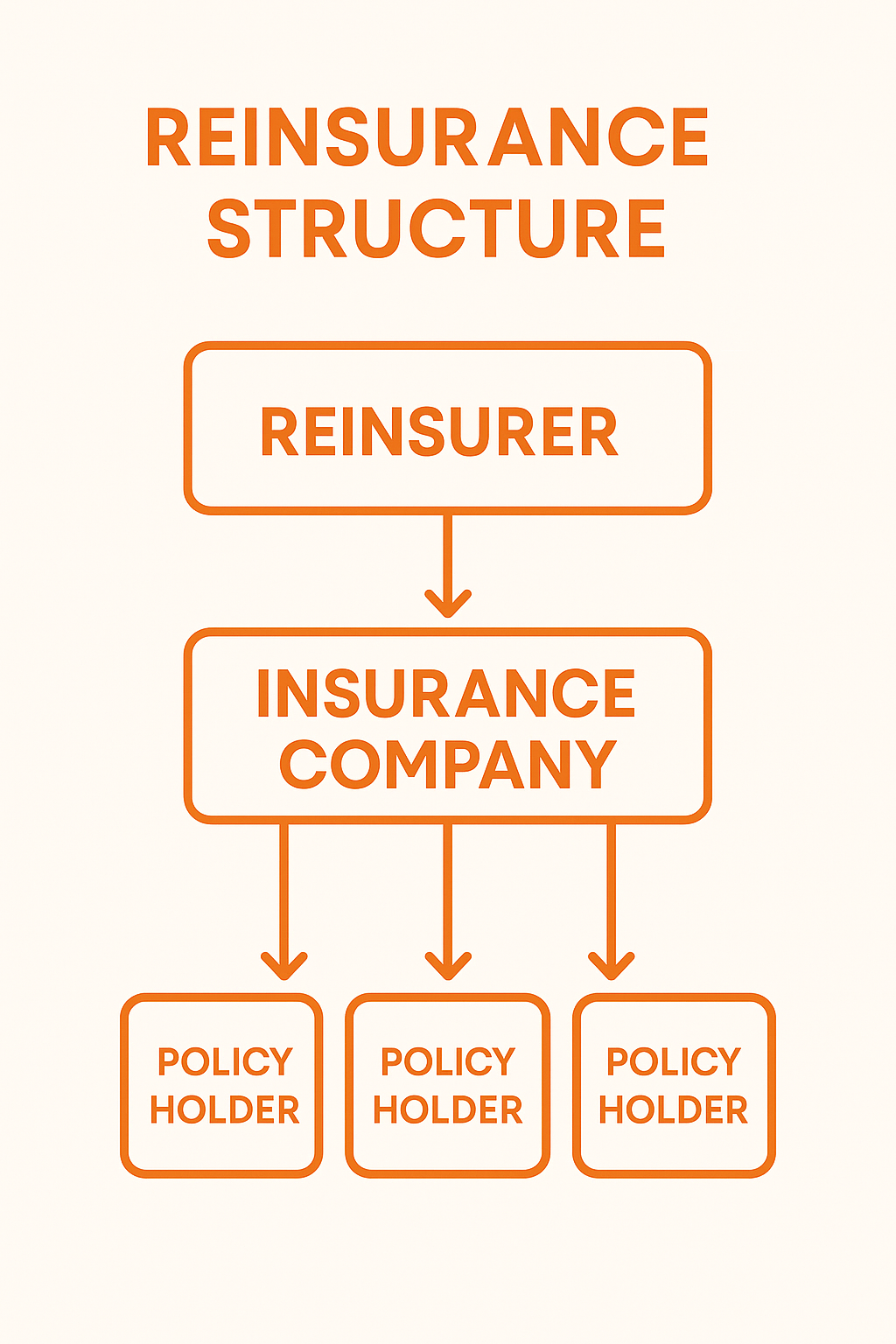

Our Reinsurance Structure

A balanced approach to risk transfer that enhances our financial security

Treaty Reinsurance

Automatic coverage for entire portfolios of risk, providing efficient protection for our book of business.

Facultative Reinsurance

Case-by-case arrangements for specific large or complex risks that require specialized coverage.

Proportional Treaties

Sharing both premiums and claims with reinsurers in agreed-upon proportions across specified lines of business.

Excess of Loss Protection

Coverage that activates when claims exceed predetermined retention levels, protecting against severity risks.

Reinsurance Inquiries

For more information about our reinsurance program, please contact our Reinsurance Department.

Contact Reinsurance Team